1. Cash flow - The amount of money flowing into and out of a business over a period of time.

2. Cash Inflows - RECEIPTS OF CASH, typically arising from sales of items, payments by debtors, loans received, rent charged, sales of assets and interest received.

3. Cash Outflows- PAYMENTS OF CASH, typically arising from the purchase of items, payments to creditors, loans repaid or given, rental payments, purchase of assets and interest payments.

4. Net Cash Flow - The sum of cash inflows to an organisation minus the sum of cash outflows over a period of time.

To understand the concept of cash-flow, check out this website which has animations to demonstrate positive, negative and stable cash flow = http://www.bized.co.uk/learn/business/accounting/cashflow/simulation/positive.htm

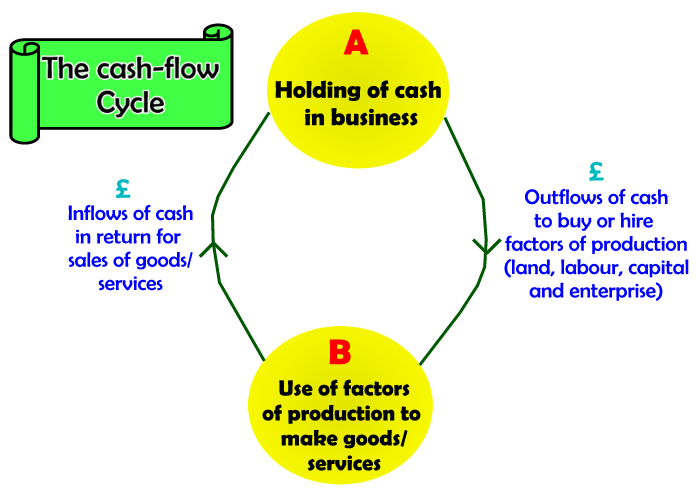

The Cash-flow Cycle

Cash-flow cycle - The regular pattern of inflows and outflows of a cash within a business.

- Cash leaves the business between A and B, but then flows back into the business between B and A.

- Usually there is a DELAY between outflows and inflows of cash.

- This can cause cash-flow problems.

The extent to which cash-flow is a problem depends on:

- The amount of cash held at the beginning of the cash-flow cycle

- The length of time required to convert inputs into outputs.

- The level of credit payments by customers.

- The amount of credit offered by suppliers

Cash-flow Forecasting

Cash-flow forecasting is the process of estimating the expected cash inflows and cash outflows over a period of time. Cash flow is often seasonal, so it is advisable to forecast for a period of 1 year.

Cash-flow statement: A description of how cash flowed into and out of a business during a particular period of time.

A cash flow forecast attempts to PREDICT the FUTURE whereas a cash-flow statement DESCRIBES what actually happened in the PAST.

Sources of cash-flow forecasting

To create a cash-flow forecast, a business must use various sources:

1. Previous cash-flow forecasts

An established business can examine forecasts from previous years but still taking into considerations any changes in business activity.

2. Cash-flow Statements

Using last year's cash-flow statement with a description of its financial year. This is an excellent foundation for next year's forecast.

--- Note both of these sources are not available to start-up businesses ---

3. Consumer Research

Research into potential sales and prices that potential customers would deem acceptable. Allowing the business to forecast sales revenue. Could also identify seasonal variation in sales revenue.

4. Study of similar businesses, such as competitors

Possible to gain information from similar businesses, particularly businesses not competing in the same geographical area.

5. Establishing the level of resources needed

Using the probable sales level of the business to calculate the resources that the business will need. e.g the cost of resources (machinery, rent, wages etc...)

6. Banks

Commercial banks have considerable expertise in supporting and handling the finances of a small business. Local Branches also may have expertise in specific industries. E.g. a bank located in a tourist area will have expertise in the hotel industry.

7. Consultants

Can gain expert opinion on how to forecast cash flow accurately.

8. The cash-flow forecast itself

Early drafts of the cash-flow forecast are used to build up on the final forecast. E.g. A early draft may indicate a difficulty such as a shortage of cash. A step can be done to rectify this problem, like getting an overdraft from the bank.

Possible Causes of Inaccuracy/ Problems of Cash-flow forecasting

1. Changes in the economy

Changes in economic growth and unemployment levels might mean consumers have less (or more) spending power. Also inflation (increase in prices) means purchasing power decreases.

2. Changes in consumer tastes

Change in consumer opinions. Mostly in fashion and technology markets.

3. Inaccurate market research

e.g. Targeted the wrong group of consumers, small samples, biased questions

4. Competition

New competitors entering the market or a competitor increasing its market share. Will affect the business' level of success.

5. Uncertainty

E.g. Cost over-estimates or under-estimates

Parts of a Cash-flow Forecast

- Cash Inflows

- Cash Outflows

- Net cash flow (Cash inflows - Cash Outflows)

- Opening balance

- Closing Balance - the amount of money left in the bank at the end of the month -

(Opening Cash Balance + Net cash flow)

An example of a cash flow forecast:

Why businesses forecast cash flow

- To identify potential cash-flow problems in advance (e.g. inability to meet payment obligations)

- To guide the firm towards appropriate action (taking a problem and use an action to overcome the difficulty. e.g. change plans like not building the office extension which was causing a predicted cash shortage).

- To make sure that there is sufficient cash available to pay suppliers and creditors and to make other payments. (e.g. planning cash inflow in order to make payments, may require an overdraft for example)

- To provide evidence in support for a request for financial assistance (e.g. asking a bank for an overdraft) - Proving why the firm needs help and how it will be paid back.

- To avoid the possibility of the company being forced out of business (into liquidation) because of a forthcoming shortage of money - Business can still be profitable but have no cash as it is tied up in stock and buildings.

- To identify the possibility of holding too much cash - Too little machinery and stock to be less productive and make less profit.

I'm following your blog for a long time and it's really helpful for me. For the small scale business cash flow statement is as important as it makes sure that your company will know when funds are available and how you can allocate them. MoolahMore Cash flow forecasting and cash flow analysis tool

ReplyDeleteCash flow forecasting is a valuable tool for managing your business's finances and ensuring you have a clear understanding of your future cash position. By utilizing cash flow forecasting, you gain better visibility into your business's financial health and can make informed decisions to manage your cash effectively, seize opportunities, and mitigate risks. Cash flow forecasting software

ReplyDelete