1.

The first website I recommend is linked below and can be used for both AS and A2 Business Studies.

I love how all the chapters and units are organised into folders and in each chapter it provides:

- The specification of what you need to know

- Theory (in the form of a PDF which you can print)

- It has activities/worksheets with questions, so you can practice what you had learnt from the theory.

- It has additional reading on the topic which can help improve your understanding and knowledge of the theory.

- Finally, it has revision notes which you can add to your own class notes and print off.

Check this website out, it is a difficult one to find on the internet and is a real gem! :)

http://www.holyfamily.ngfl.ac.uk/minisites/a-levelbusiness/

2.

This is an excellent website which can be used for GCSE and A-level.

http://www.businessstudiesonline.co.uk/live/

3.

The Student Room is a forum for all students, which is open for you to read and you can join it if you want to participate and ask questions. I used this website a lot during my exams, and even after my exams to see what people thought of the test. If you also want to discuss careers in business or doing a degree in it, this site is great.

http://www.thestudentroom.co.uk/forumdisplay.php?f=111

4.

Want some model answers to questions? This is the place!! Print them off and learn how to get full marks in your AS Business Exam.

http://www.hodderplus.co.uk/ocrbusiness/

5.

If you want to revise critical path analysis or you need it to be explained to you again, you are sure to understand it after watching this video! I also recommend you check out more of this youtuber's videos as they are really helpful and good.

https://www.youtube.com/watch?v=-EqWGSdQSvI&list=PLBuW3SAj0djnHfFQG4m9VbN03mA_MMLlv

Showing posts with label business revision. Show all posts

Showing posts with label business revision. Show all posts

Monday, 28 July 2014

Sunday, 25 May 2014

Chapter 19: Improving Organisation Structures

Organisation Structure: The relationship between different people and functions in an organisation - both vertically, from shop-floor workers through supervisors and managers to directors, and horizontally between different functions and people at the same level.

Organisation Chart: A diagram showing the lines of authority and layers of hierarchy in an organisation.

A line between two different levels (e.g. A team leader and a supervisor) represents a relationship where instructions are passed downwards, and reports and feedback are passed upwards within the organisation.

When describing the person immediately ABOVE someone in the organisation chart as his or her LINE MANAGER. For example, The team leader's line manager is the manager.

The reporting system from the top of the hierarchy down to the bottom is called the CHAIN OF COMMAND.

Organisational Hierarchy: The vertical division of authority and accountability in an organisation.

Levels of Hierarchy: The number of different supervisory and management levels between the shop floor and the chief executive in an organisation.

In this organisation chart, the marketing function has 3 levels.

Span of Control

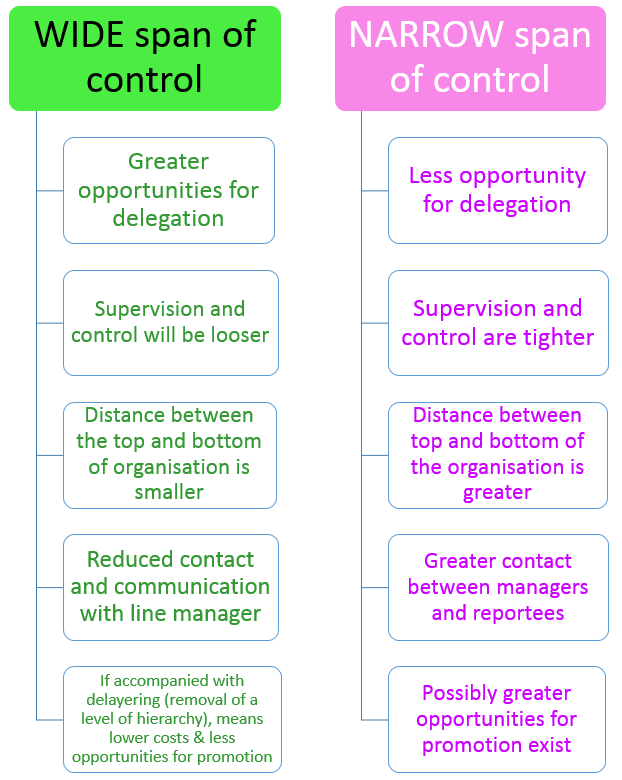

Span of control: The number of subordinates whom a manager is required to supervise directly.

If a manger has a lot of subordinates to answer to --> Wide Span of control

If a manger has few subordinates to answer to --> Narrow Span of Control

Relationship between: Span of Control and levels of hierarchy

Normally an organisation with a tall hierarchical structure (i.e. many layers of management), each had a narrow span of control.

Now it is becoming more popular to have a flatter hierarchical structure (reducing the layers of management) and each manager will have a wider span of control.

Here organisation A is a tall structure with 4 layers of management. Organisation B is a flat structure with 2 layers of management. A the top of the triangle is the Top management and at the bottom is the shop-floor workers:

Centralised and Decentralised Structures

Centralised involves authority and responsibility for decision making being in the hands of senior managers (e.g. at a head office).

Decentralisation means that this responsibility is given to individual units/departments/branches or lower-level managers.

Benefits of centralised decision making:

Delegation is the process of passing authority down the hierarchy from a manager to a subordinate.

Responsibility

Being accountable for one's actions.

e.g. A personnel manager may be responsible for ensuring that all employees receive appropriate training for their particular job.

Authority

The ability or power to carry out a task.

Subordinates must have the authority to undertake the various tasks delegated to them. The manager must formally pass authority on to them and is clear and explicit.

For example, if a manager was due to be away and did not give her assistant the authority to sign cheques or make decisions on her behalf, the firm's activities may grind to halt.

Limits must also be laid out.

Accountability

The extent to which a named individual is held responsibility for the success or failure of a particular policy, project or piece of work.

Accountability remains firmly at the top of the organisation structure.

Factors that can make delegation effective:

Communication Flows

Communication: The process of exchanging information or ideas between two or more individuals or groups.

Internal Communication: The exchange of information that takes place within an organisation (e.g. at department meetings, in team briefing sessions and in memos to staff)

External Communication: The exchange of information that takes place with individuals, groups and organisations outside the business (e.g. via advertising material, telephone calls to suppliers and letters to customers).

Good communication means that the organisation will have a more motivated and committed workforce, make better decisions, makes the business better coordinated, and find it easier to implement change.

The Communication Process

One and Two-way communication

One-way communication: Communication WITHOUT any FEEDBACK (e.g. putting a notice on a notice board, or giving instructions in an authoritarian manner that allows no comment or questions from the listener).

Two-way communication: Communication WITH FEEDBACK (e.g. giving instructions in a manner that allows for questions to be asked or comments to be made, a discussion or a question-and-answer session).

In one-way communication, the communicator cannot be sure if the message was fully understood and if it was effective. This communication is associated with autocratic management styles.

However two-way communication ensures that communication is fully understood and so is more effective. Two-way communication is an example of democratic management, effective delegation, empowerment and team working.

Communication Channels

Communication Channel: The route through which communication occurs.

Examples: A team briefing session, works council (a discussion between management and employee representatives about company plans)

Open and closed channels of communications

Open channels of communication: Any staff member is welcome to see, read or hear the discussions and conclusions.

Closed channel of communications: Access to the information is restricted to a named few.

Formal and informal channels of communication

Formal channels of communication: Communication channels established and approved by senior management, within which any form of communication is regarded as formal (e.g. meetings of departmental heads, personnel department meetings and production team briefing sessions).

Informal channels of communication: Means of passing information outside the official channels, often developed by employees themselves (e.g. the 'grapevine' and gossip).

Vertical and lateral communication

Vertical communication: When information is passed up and down the chain of command.

Two types of vertical communication:

1. Downwards communication- Transmitted from the top to the bottom of the organisation, or from superior to subordinate. Usually used to give instructions or inform employees about decisions.

2. Upwards communication- Transmitted from the bottom to the top of the organisation, or from subordinate to superior E.g. feedback, advising of any problems. It can help to improve downwards communication and provide feedback on its effectiveness.

Lateral Communication: When people at the same level within an organisation pass information to each other.

e.g. The finance dep. telling the marketing dep. about the budget available for a sales promotion.

What influences the structure of an organisation?

Organisation Chart: A diagram showing the lines of authority and layers of hierarchy in an organisation.

A line between two different levels (e.g. A team leader and a supervisor) represents a relationship where instructions are passed downwards, and reports and feedback are passed upwards within the organisation.

When describing the person immediately ABOVE someone in the organisation chart as his or her LINE MANAGER. For example, The team leader's line manager is the manager.

The reporting system from the top of the hierarchy down to the bottom is called the CHAIN OF COMMAND.

Organisational Hierarchy: The vertical division of authority and accountability in an organisation.

Levels of Hierarchy: The number of different supervisory and management levels between the shop floor and the chief executive in an organisation.

In this organisation chart, the marketing function has 3 levels.

Span of Control

Span of control: The number of subordinates whom a manager is required to supervise directly.

If a manger has a lot of subordinates to answer to --> Wide Span of control

If a manger has few subordinates to answer to --> Narrow Span of Control

Relationship between: Span of Control and levels of hierarchy

Normally an organisation with a tall hierarchical structure (i.e. many layers of management), each had a narrow span of control.

Now it is becoming more popular to have a flatter hierarchical structure (reducing the layers of management) and each manager will have a wider span of control.

Here organisation A is a tall structure with 4 layers of management. Organisation B is a flat structure with 2 layers of management. A the top of the triangle is the Top management and at the bottom is the shop-floor workers:

Centralised and Decentralised Structures

Centralised involves authority and responsibility for decision making being in the hands of senior managers (e.g. at a head office).

Decentralisation means that this responsibility is given to individual units/departments/branches or lower-level managers.

Benefits of centralised decision making:

- Greater control over decisions made

- More consistency

- More efficient use of specialist skills of employees and managers.

- Increased motivation due to empowerment of lower-level managers

- Skills developed in lower-level managers

- Quicker decision making (However it would be hard for lower-level managers to have an overview and be aware of the wider impact of their decisions)

Delegation is the process of passing authority down the hierarchy from a manager to a subordinate.

Responsibility

Being accountable for one's actions.

e.g. A personnel manager may be responsible for ensuring that all employees receive appropriate training for their particular job.

Authority

The ability or power to carry out a task.

Subordinates must have the authority to undertake the various tasks delegated to them. The manager must formally pass authority on to them and is clear and explicit.

For example, if a manager was due to be away and did not give her assistant the authority to sign cheques or make decisions on her behalf, the firm's activities may grind to halt.

Limits must also be laid out.

Accountability

The extent to which a named individual is held responsibility for the success or failure of a particular policy, project or piece of work.

Accountability remains firmly at the top of the organisation structure.

Factors that can make delegation effective:

- Based on mutual trust between manager and subordinate

- Get the right person to do the job (skilled, trained, can do the task effectively and efficiently)

- Ensure that the interesting tasks, as well as more boring ones, are delegated.

- Effective support system provided (e.g. allows the subordinate to ask questions and discuss issues with their delegated tasks)

- Managers should delegate responsibility and authority. Limitations of the subordinate's authority should be made clear too.

- Managers should not interfere with delegated tasks unless something is going seriously wrong. Subordinates need to feel trusted and that managers have confidence in them.

Communication Flows

Communication: The process of exchanging information or ideas between two or more individuals or groups.

Internal Communication: The exchange of information that takes place within an organisation (e.g. at department meetings, in team briefing sessions and in memos to staff)

External Communication: The exchange of information that takes place with individuals, groups and organisations outside the business (e.g. via advertising material, telephone calls to suppliers and letters to customers).

Good communication means that the organisation will have a more motivated and committed workforce, make better decisions, makes the business better coordinated, and find it easier to implement change.

The Communication Process

One and Two-way communication

One-way communication: Communication WITHOUT any FEEDBACK (e.g. putting a notice on a notice board, or giving instructions in an authoritarian manner that allows no comment or questions from the listener).

Two-way communication: Communication WITH FEEDBACK (e.g. giving instructions in a manner that allows for questions to be asked or comments to be made, a discussion or a question-and-answer session).

In one-way communication, the communicator cannot be sure if the message was fully understood and if it was effective. This communication is associated with autocratic management styles.

However two-way communication ensures that communication is fully understood and so is more effective. Two-way communication is an example of democratic management, effective delegation, empowerment and team working.

Communication Channels

Communication Channel: The route through which communication occurs.

Examples: A team briefing session, works council (a discussion between management and employee representatives about company plans)

Open and closed channels of communications

Open channels of communication: Any staff member is welcome to see, read or hear the discussions and conclusions.

Closed channel of communications: Access to the information is restricted to a named few.

Formal and informal channels of communication

Formal channels of communication: Communication channels established and approved by senior management, within which any form of communication is regarded as formal (e.g. meetings of departmental heads, personnel department meetings and production team briefing sessions).

Informal channels of communication: Means of passing information outside the official channels, often developed by employees themselves (e.g. the 'grapevine' and gossip).

Vertical and lateral communication

Vertical communication: When information is passed up and down the chain of command.

Two types of vertical communication:

1. Downwards communication- Transmitted from the top to the bottom of the organisation, or from superior to subordinate. Usually used to give instructions or inform employees about decisions.

2. Upwards communication- Transmitted from the bottom to the top of the organisation, or from subordinate to superior E.g. feedback, advising of any problems. It can help to improve downwards communication and provide feedback on its effectiveness.

Lateral Communication: When people at the same level within an organisation pass information to each other.

e.g. The finance dep. telling the marketing dep. about the budget available for a sales promotion.

What influences the structure of an organisation?

- The size of the organisation - The larger the organisation --> More complex its structure --> More layers of hierarchy, divisions or departments.

- The nature of the organisation - Manufacturing sector? Service sector? National? Single product or multiple? Needs tight control?

- The culture and attitudes of senior management - Depends on management style (Autocratic and controlling or democratic and participative)

- The skill and experience of its workforce - Do the workers have little skills and do repetitive jobs? Or are they high skilled and do different jobs?

Saturday, 24 May 2014

Chapter 18: Measuring and Increasing Profit

Profit

The difference between the income of a business and its total costs.

Profit= Total Revenue - Total Costs

Profitability

The ability of a business to generate profit or the efficiency of a business in generating profit.

Profitability relates the amount of profit to the size of the company.

Profitability % = Profit (£) X 100

Revenue (£)

Example:

A business makes £100,000 profit in a year by selling £700,000 worth of goods and services over 12 months. Calculate its profitability.

Answer: 100,000 X 100 = 14.3%

700,000

There are two measures of the size of the company:

1. Sales Revenue (adding up all the income over a period of time, typically a year)

2. Capital Employed (Share capital is the same thing. Involves adding up all the money that has been invested in the company by the owners)

Net Profit Margin

Net profit margin compares the amount of profit to the total sales revenue of the company.

Net Profit Margin Definition: This measures net profit (although operating profit can be used) as a percentage of sales (turnover). Net and operating profits are considered the best measure of a firm's profit, while sales turnover is an excellent measure of scale.

What is net profit and operating profit?

Net profit is profit made from ALL ACTIVITIES. Sometimes this is misleading as a business may make a lot of money by selling an asset that it owns.

Operating Profit is profit made from TRADING (i.e. the MAIN ACTIVITIES of the business). For example, it does not include money gained from a sale of asset.

Example 1:

McDonalds financial year 2006/7. The net profit before tax in this year was £319.2m. The sales revenue was £5698.4m and the capital investment was £2796.3m. What is the net profit margin for this year?

Answer: 319.2 X 100

5,698.4 = 5.6%

Example 2:

Calculate the net profit margin if a business has £53,000 in sales, variable costs of £12,920 and fixed costs of £21,000.

Answer: £53,000 - (12,920 + 21,000) x 100

53,000 = 36% Net Profit Margin

Whether a percentage is good or bad, can be determined by:

- Comparisons with previous years' figures

- Other businesses in similar industries or competitors

For example, a lowering of the % net profit margin could indicate that the business is having problems controlling its costs.

But an increase could show the business is becoming more efficient in controlling costs or is able to set a higher price.

Return on Capital (ROC)

ROC compares the amount of net profit to the capital invested in the company.

Return of capital Definition: Ratio showing net profit (operating profit if also used) as a percentage of capital invested.

Capital Invested: All of the money provided to the business by owners.

Example 3:

Calculate the return on capital employed if a business invests £6,000 in a new project and receives a return of £480.

Answer: 480 X 100

6,000 = 8%

Whether a return is good or bad may depend upon the opportunity cost. For example, a business may consider a return of 5% as too low, as it could have got 5% from the bank.

Methods of improving profits and profitability

3 basic methods to increase profit:

An increase in the price will widen the profit margin (difference between the price and the cost) and each product sold will generate more profit.

- Most effective with products that are a necessity or have no close substitutes.

- If this is not true, then there is a danger that demand will move to competitors or rival products.

Decreasing Costs

If there are no changes in demand --> It will increase the total profit.

If changes in costs leads or a decrease in quality or efficiency --> Demand for the product will fall.

Could happen because inferior raw materials are being used or workers accepting a lower wage are less motivated and so less efficient than those being paid a higher wage.

Also by reducing overheads (Such as rent, office expenses and machinery costs) - the costs could damage sales. E.g. a retail outlet may be reluctant to move premises with a lower rent if the new location is less accessible to customers. In this case, the savings in costs may be much lower than the decline in sales revenue caused by the unfavourable location.

Other methods of improving profit/profitability

Profitable firms may be short of cash as:

- Its wealth may lie in assets rather than cash (High stock levels)

- Wealth will be in debtors rather than cash (Gives credit)

- Pay dividends to shareholders

- Repaying a long-term loan

Liquidity: The ability to convert an asset into cash without loss or delay.

A firm may buy an asset and expect to make a profit from it in the future. However, cash payments for this asset may lead to the firm being unable to pay suppliers or workers. This could lead to liquidation, forcing the firm to close and sell its assets in order to make these cash payments.

The difference between the income of a business and its total costs.

Profit= Total Revenue - Total Costs

Profitability

The ability of a business to generate profit or the efficiency of a business in generating profit.

Profitability relates the amount of profit to the size of the company.

Profitability % = Profit (£) X 100

Revenue (£)

Example:

A business makes £100,000 profit in a year by selling £700,000 worth of goods and services over 12 months. Calculate its profitability.

Answer: 100,000 X 100 = 14.3%

700,000

There are two measures of the size of the company:

1. Sales Revenue (adding up all the income over a period of time, typically a year)

2. Capital Employed (Share capital is the same thing. Involves adding up all the money that has been invested in the company by the owners)

Net Profit Margin

Net profit margin compares the amount of profit to the total sales revenue of the company.

Net Profit Margin Definition: This measures net profit (although operating profit can be used) as a percentage of sales (turnover). Net and operating profits are considered the best measure of a firm's profit, while sales turnover is an excellent measure of scale.

What is net profit and operating profit?

Net profit is profit made from ALL ACTIVITIES. Sometimes this is misleading as a business may make a lot of money by selling an asset that it owns.

Operating Profit is profit made from TRADING (i.e. the MAIN ACTIVITIES of the business). For example, it does not include money gained from a sale of asset.

McDonalds financial year 2006/7. The net profit before tax in this year was £319.2m. The sales revenue was £5698.4m and the capital investment was £2796.3m. What is the net profit margin for this year?

Answer: 319.2 X 100

5,698.4 = 5.6%

Example 2:

Calculate the net profit margin if a business has £53,000 in sales, variable costs of £12,920 and fixed costs of £21,000.

Answer: £53,000 - (12,920 + 21,000) x 100

53,000 = 36% Net Profit Margin

Whether a percentage is good or bad, can be determined by:

- Comparisons with previous years' figures

- Other businesses in similar industries or competitors

For example, a lowering of the % net profit margin could indicate that the business is having problems controlling its costs.

But an increase could show the business is becoming more efficient in controlling costs or is able to set a higher price.

Return on Capital (ROC)

ROC compares the amount of net profit to the capital invested in the company.

Return of capital Definition: Ratio showing net profit (operating profit if also used) as a percentage of capital invested.

Capital Invested: All of the money provided to the business by owners.

Example 3:

Calculate the return on capital employed if a business invests £6,000 in a new project and receives a return of £480.

Answer: 480 X 100

6,000 = 8%

Whether a return is good or bad may depend upon the opportunity cost. For example, a business may consider a return of 5% as too low, as it could have got 5% from the bank.

Methods of improving profits and profitability

3 basic methods to increase profit:

- Increase the price (to widen the profit margin)

- Decrease the costs (e.g. by sourcing cheaper suppliers, employing fewer people, cutting back on advertising)

- Increasing the sales volume (More advertising or product development)

An increase in the price will widen the profit margin (difference between the price and the cost) and each product sold will generate more profit.

- Most effective with products that are a necessity or have no close substitutes.

- If this is not true, then there is a danger that demand will move to competitors or rival products.

Decreasing Costs

If there are no changes in demand --> It will increase the total profit.

If changes in costs leads or a decrease in quality or efficiency --> Demand for the product will fall.

Could happen because inferior raw materials are being used or workers accepting a lower wage are less motivated and so less efficient than those being paid a higher wage.

Also by reducing overheads (Such as rent, office expenses and machinery costs) - the costs could damage sales. E.g. a retail outlet may be reluctant to move premises with a lower rent if the new location is less accessible to customers. In this case, the savings in costs may be much lower than the decline in sales revenue caused by the unfavourable location.

Other methods of improving profit/profitability

- Investment in fixed assets - Buying new equipment, buildings or vehicles can allow the business to EXPAND its scale of operation and possibly IMPROVE both the EFFICIENCY of production and the QUALITY of the product. As a result, the business could increases its profits by achieving higher sales volume, charging a higher price and cutting its costs.

- Product development - Introduce new, unique products in order to attract more customers. Could allow a higher price to be charged too.

- Marketing - Encourages customers to buy more of the business' products. (e.g. A clever advertising campaign or a sponsorship). Increases the value of the product to the customer, this enables a higher price to be charged. Although marketing adds to the costs of the business, these extra costs should be offset by the additional revenue generated, so profit should increase.

- Human Resource Strategies - Careful selection, recruitment and training of staff + Motivation Strategies --> Greater efficiency of the workforce --> Greater output --> Higher quality products --> Better customer service --> Higher profits

Profitable firms may be short of cash as:

- Its wealth may lie in assets rather than cash (High stock levels)

- Wealth will be in debtors rather than cash (Gives credit)

- Pay dividends to shareholders

- Repaying a long-term loan

Liquidity: The ability to convert an asset into cash without loss or delay.

A firm may buy an asset and expect to make a profit from it in the future. However, cash payments for this asset may lead to the firm being unable to pay suppliers or workers. This could lead to liquidation, forcing the firm to close and sell its assets in order to make these cash payments.

Labels:

aqa,

assets,

business,

business revision,

business studies,

buss2,

capital employed,

cash flow,

chapter 18,

increasing profit,

increasing profitability,

measuring profit,

net profit margin,

profit,

profitability

Chapter 17: Improving Cash Flow

Cash Flow

Cash flow is the amounts of money flowing into and out of a business over a period of time.

Too much cash = Firm will have less machinery and stock than it can afford and so make less profit.

Too little cash= Threaten survival if a bill cannot be paid.

To get the right balance= Plan its cash holdings --> By having a cash-flow forecast --> Firm can identify problems and take appropriate action (e.g. arranging a bank overdraft)

Causes of cash-flow problems

1. Seasonal Demand

Companies typically incur costs in producing in advance of the peak season for sales. However because the problem is predictable, it is easy to persuade suppliers to provide credit or to negotiate a bank overdraft.

2. Overtrading

Firms become too confident and expand rapidly, not organising sufficient long-term funds. Putting a strain on working capital. Businesses often give credit to customers. Rapid expansion = Businesses to buy more materials but lacks money, this is because customers are not paying for the goods as soon as they are sold. This leaves the business short of cash.

3. Over-investment in fixed assets

Firms invest in fixed assets to grow, but leaves them with inadequate cash for day-to-day payments. Could drain the business of finance and lead to cash-flow problems. Equipment and buildings cannot easily be turned back into cash. Extreme situations = Can't pay debts, even though the business has plenty of assets.

4. Credit sales

Marketing dep. would want to give credit to customers --> To encourage them to buy --> lead to lack of cash in the organisation if sales are not leading to immediate receipts of cash.

5. Poor stock management

Hold excessive stock levels, tying up cash that could be used for other purposes.

High level of stock= Danger --> Stock becomes worthless as it is --> out-of-date or unfashionable.

But Low stock levels= Limit sales --> esp. impulse buys

Buying large quantities of stock --> Business benefits from discounts. Can this offset the costs of carrying high stock levels?

6. Poor management of suppliers

A well managed business should be able to negotiate a credit period with suppliers so that payment from customers reaches the business at the same time the business needs to pay suppliers.

Good supply chain management also means negotiations on a reasonably low price so money won't be wasted. It also ensures prompt deliveries of materials so customers will not be lost.

7. Unforeseen changes

Internal changes --> e.g. machinery breakdown

External Factors --> e.g. a change in government legislation

Due to? Management errors? Poor planning? Bad luck?

8. Losses or low profit

Remember that cash flow and profit is different but linked.

Sales revenue less than expenditure --> Usually have less cash than one making a healthy profit.

Also creditors and investors would be less likely to put money into a business that is not expecting to make profit in the future.

Unless a loss-making business can prove it will be profitable in the future, it will be difficult to overcome cash-flow problems.

Methods of improving cash flow

1. Bank overdraft

An agreement whereby the holder of a current account at a bank is allowed to withdraw more money than there is in the account. The agreement specifies the maximum level of the overdraft.

Benefits of an overdraft:

- Administrative convenience - Easy to arrange, once agreed= Confirmation only needed on an annual basis

- Flexibility - Flexible because it can be used to pay for whatever the business requires at the time

- Interest is paid on the amount owed - Only pay interest on the amount of the overdraft that is actually used. Paid on a daily basis.

- No security necessary - Unlike a bank loan, no collateral needed.

Problems of an overdraft:

- Variable interest payments - Based on flexible interest rates. The interest paid will rise and fall with the Bank of England's base rate. Difficult to budget accurately, as the bank may change its rate of interest on a monthly basis.

- Higher interest rate - Higher than a short-term bank loan. Overdraft can prove to be more expensive than a loan.

- Immediate repayment - Agreement to an overdraft means bank can demand immediate repayment. Business with cash flow problems may be forced to pay back the money to the bank at exactly the same time the business is most vulnerable.

2. Short-term Loan

A sum of money provided to a firm or individual for a specific, agreed purpose. Repayment of the loan will take place within two years, and possibly much less.

Benefits of a bank loan:

- Fixed interest repayments - Fixed rate of interest. The interest and repayment schedule is calculated at the time of the loan, so it is easy for a business to know whether it can afford to repay the loan. Easy to budget the loan repayments, can pay the same amount each month over the duration of the loan.

- Lower interest rate - Less than the rate charged on an overdraft. A cheaper solution to a cash-flow problem.

- Higher interest repayments - Interest is paid on the whole of the sum borrowed. If the business has a healthy balance in its current account, it will not help reduce the interest repayments on the bank loan. Such payments will be a fixed sum every month. Consequently, bank loans can be more expensive than an overdraft despite the overdrafts high interest rate.

- Security - Must provide ban with security (collateral). Difficulties paying back the loan --> Bank can claim the amount owed by forcing a sale of asset. Major difficulties if asset is a large part of the business' operations.

3. Factoring (Debt factoring)

Factoring is when a factoring company (usually a bank) buys the right to collect the money from the credit sales of an organisation.

- Factoring agent usually pays the firm about 75% of its sales immediately and approximately 15-20% on receipt of the debt.

- Firm therefore loses some revenue (about 5-10% depending on length of time and current interest rate), which is the factoring company's charge for its service.

Benefits of factoring:

- Improved cash flow in the short term - Save expenses like overdraft interest charges and in extreme cases the immediate receipt of cash may keep the business alive by allowing it to pay off debts on time. Businesses who offer long credit periods to their customers in order to boost sales revenue, the immediate receipt of cash may be essential as it would be impossible for the business to wait a year for payment.

- Lower administration costs - Collecting and chasing debts is time-consuming and costly. The factoring agent specialises in this and could possibly collect more than one debt from the same firm.

- Reduced risk of bad debts - Factoring agent takes the risk and not the original company. Factoring agent can refuse to factor a debt which is too risky. Some firms contact the factoring agent before giving credit to a customer. Factoring companies have lists of customers who may be a high risk.

- Increased efficiency - Encourages companies to be more careful with their provision of credit. If the business has a reputation for having no customers with bad debts attached to them, the factoring company will reduce the cost of factoring to that business. This will give firms an incentive to be more efficient in their provision of credit.

- Loss of revenue - Business using factoring will lose 5-10% of its revenues. Reducing profit. But is possible to increase price charged to customers where credit terms are being offered.

- High Cost - Business pays more for the factoring company's services than it would to pay a bank for a loan (as there are admin expenses involved in chasing up debts). But there are admin savings from the business not having to chase up debts itself....

- Customer relations problems - Customers may prefer to deal directly with the business that sold them the product. An aggressive factoring company could upset certain customers, who will blame their bad experience on the original seller of the product.

4. Sales of Assets:

When a business transfers ownership of an item that it owns to another business or individual, usually in return for cash.

- Sales of assets --> Most likely to be used to overcome cash flow problems --> when a business is changing direction or moving out of a particular market.

- Sales of assets could be used to: ~ Pay a debt or ~ Build up a bank balance.

2 main benefits of sales of assets:

1. Income - It can raise a considerable sum of money particularly in the case of a large asset such as a building.

2. Profitability - A particular asset may not be contributing towards the business's overall success. In this case, the sale of the asset may ease cash-flow problems and enhance its overall profitability (as it is just adding to costs unnecessarily)

Problems of sales of assets:

1. Receiving a low value for the asset - Assets such as buildings or machinery --> Difficult to sell quickly, the business is looking for a quick sale --> Must accept a much lower price than true value.

May not be a good strategy --> damaging effect on long-term profitability.

2. Reduced ability to make a profit - Fixed assets enable a firm to produce the goods and services that create its profit. Exceptions= When assets are no longer required or when the cash-flow situation threatens the survival of the organisation.

5. Sale and leaseback of assets:

When assets that are owned by a firm are sold to raise cash and then rented back so that the company can still use them for an agreed period of time.

Other ways of improving cash flow

1. Improving working capital control

Working Capital: The day-to-day finance used in a business, consisting of assets (e.g. cash, stock and debtors) minus liabilities (e.g. creditors and overdrafts)

- Must manage working capital to stay solvent (solvent means you are able to pay off your debts)

- Involves careful control of firm's main current assets (cash, stock and debtors) to ensure enough is there to pay creditors and make other immediate payments.

2. Cash Management

If a firm is short of cash it has 2 main options:

- Agree to an overdraft with the bank

- Set aside a contingency fund so firm can meet unexpected payments or cope with lost income. In industries subject to more rapid change, a higher contingency fund should be kept.

3. Debt Management

4. Stock Management

5. Other Methods

(See Below)

Labels:

a level,

aqa,

as level,

bank loan,

business,

business revision,

business studies,

buss2,

cash flow,

chapter 17,

debt factoring,

factoring,

improving cash flow,

overdraft,

revision,

working capital

Subscribe to:

Posts (Atom)